To successfully configure Fiscal cash registers, the following is needed:

- certificate, which can be obtained on the eDavki portal

- cadastre data of business unit(s), from which the issuing of invoices will take place

- personal tax numbers of all users which will issue the cash invoices

Configuration steps (Settings/Your company)

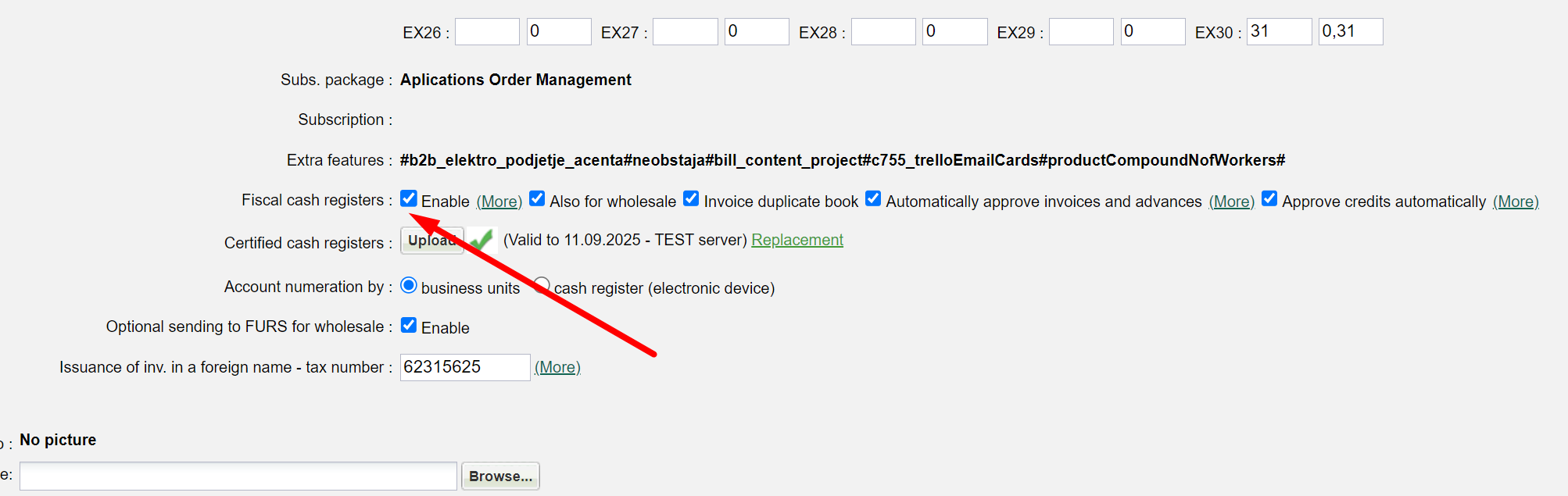

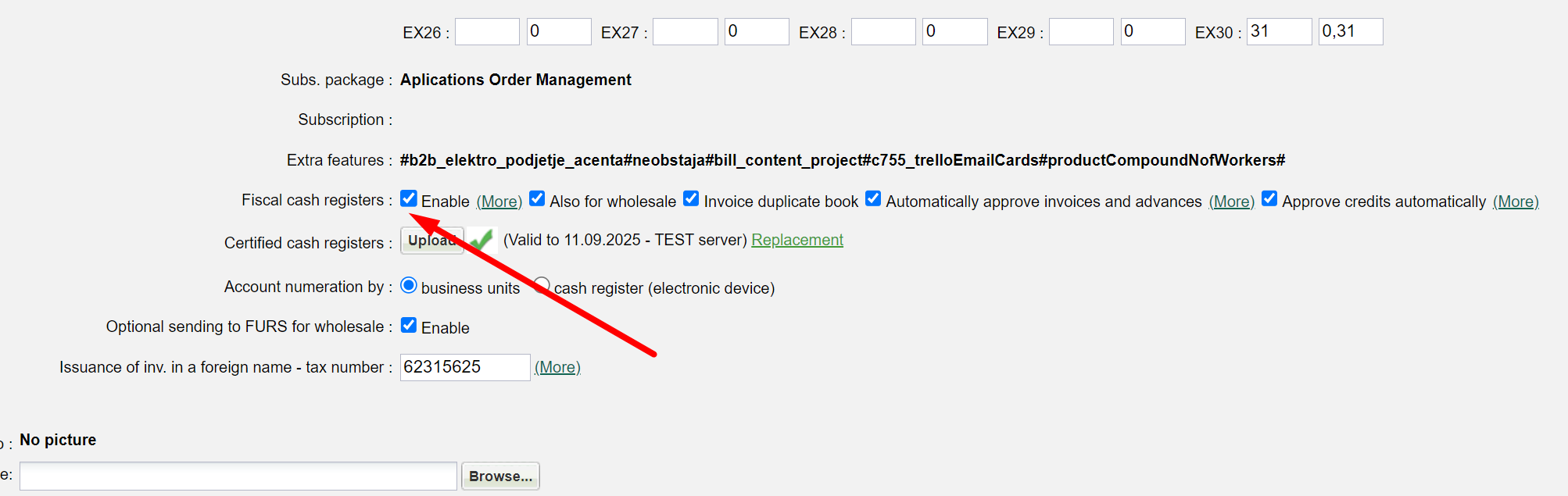

1.) Search for the “Fiscal registers” option and turn it on (the picture below).

Save settings and the program will execute logging out and re-logging.

Certificate transfer - A button for uploading the certificate will be displayed - click on it

Select/install a certificate that was received from the eDavki portal, for signature and data sending to FURS (http://www.datoteke.fu.gov.si/eDavki/PrevzemNamenskegaDigitalnegaPotrdila.pdf). For the successful transfer of the certificate, use the same password in the dialogue that you entered when downloading it from FURS.

In case of issuing invoices with different means of payment (i.e. deferred payments on the bank account), selectively sending invoices or selectively refrain from sending them to FURS can be activated for Wholesales.

FURS data - In the bottom part of the form (Settings/Your company) additional tab ''FURS data'' is displayed

3.1 FURS data

Enter the following in the tab:

- designation of business premises as previously specified in the internal act. Should be no longer than 3 characters.

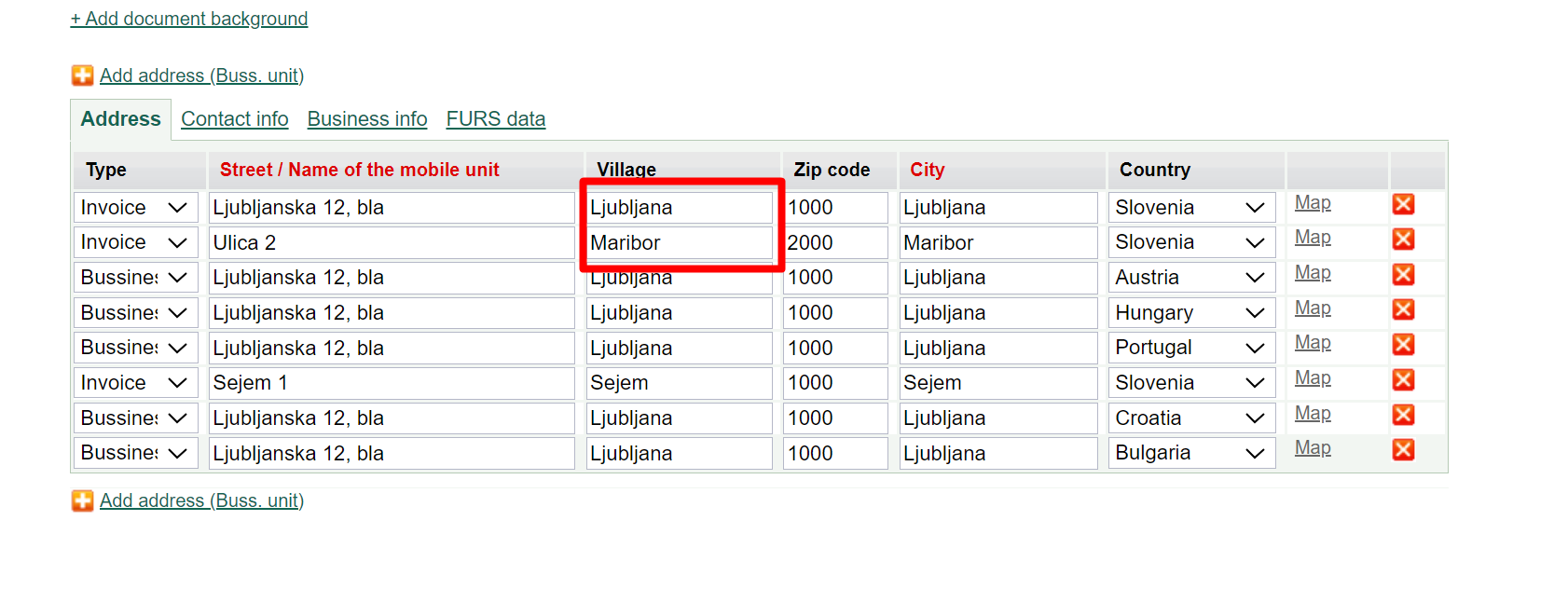

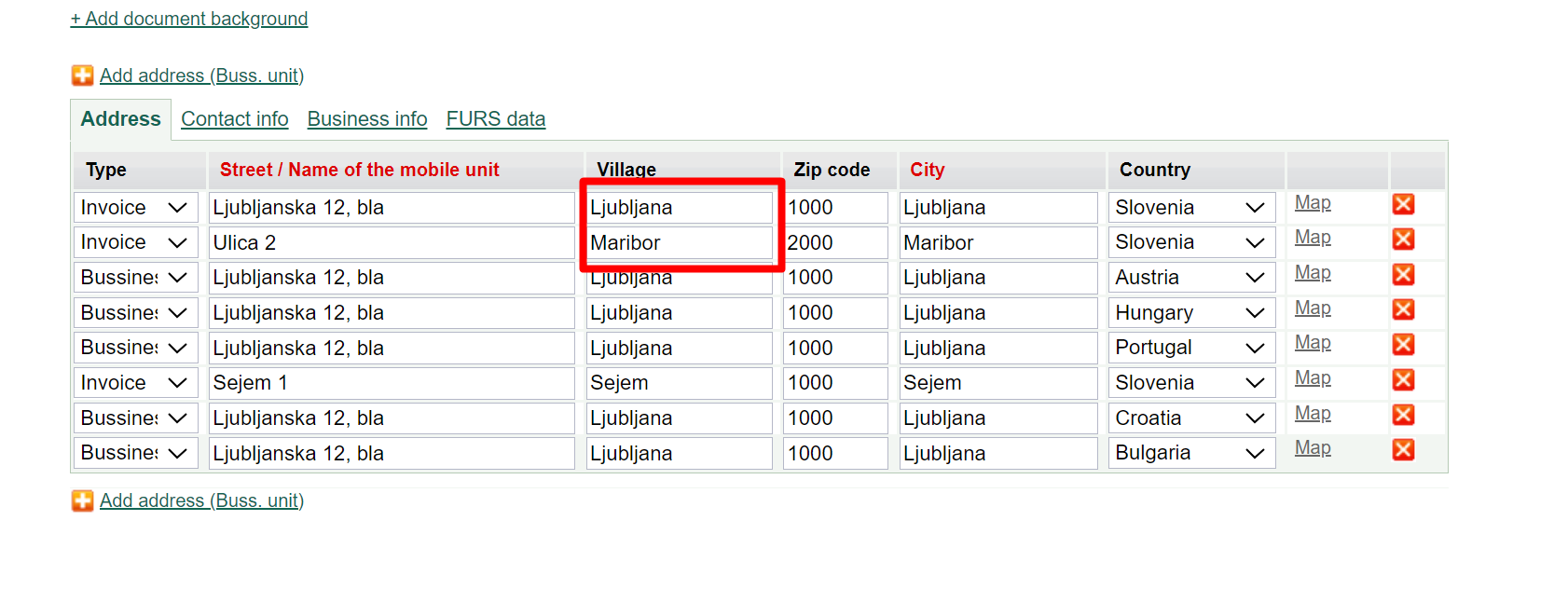

- cadastre data for each company's branch, from which invoices are issued (the picture above).

In case of facing issues when acquiring cadastre data, the following link might be helpful:

http://prostor3.gov.si/javni-arhiv/javniVpogled.jsp?rand=0.6326335820321506

3.1 Address

In the Address tab, enter the city in which the bussiness unit is located

Data entering - Users issuing the invoices

- Each user that will be issuing invoices must have a respective name, surname, and personal tax number denoted (the picture below)

- User needs to have a business unit assigned, from which he/she will be issuing invoices

- Also set up the following: business unit warehouse, cash register, retail customer, price list - authorities

Additional options

When a certificate is successfully configured, an additional option - Optional sending to FURS on wholesale'', will be displayed, mainly intended for issuing the invoices for Wholesale (if cash invoices are not issued in domestic/foreign sales, jump to point 4.) and invoices will not be sent to FURS after their printing (since the payment is received on the bank account) - if such a type of payment is supported, tick the ''Enable'' field.

Then, at the top of the invoice, select numeration that is not intended for fiscal verification or numeration that is intended for fiscal numeration, as shown in the picture below. Once the numeration is selected, it cannot be modified anymore.

If the wrong numeration is selected and the invoice is already saved, the invoice needs to be canceled and reissued

-Options for activating other functions are also available:

1. Also for wholesale - if you selling in Retail and you want to tax-verify invoices in wholesale as well (especially online stores must select this option), tick the box next to it.

2. Invoice duplicate book - if using an invoice duplicate book, you may transfer those invoices to MetaKocka.

On the retail invoice, there is an ''Invoice duplicate book'' field, tick the box next to it to enter data from invoice the duplicate book.

3. Automatic invoices and credit notes tax-verification - that way, invoices, and credit notes will be verified in the evening hours if they have not been already verified from your side (invoices are tax-verified when printed)

Invoices numeration

If you want to change the prefix, that can be done for each business unit.

Settings/ Numbering/:

Upon saving, you can start issuing invoices. Invoices are verified at FURS once they are printed for the very first time.

User for automatic issuing of invoices

If invoices are not created by users (i.e. automatic creation via API calls), it is not appropriate, to list a person as the invoice issuer if he/she has not participated in such a procedure. Suggested is the creation of a special user, to whom the Business unit and Tax number have to be assigned either way so that invoices can be tax-verified. Select the company's headquarters as the business unit address, while for the tax number, it is mandatory to use the company's tax number without the country code (do not enter the tax number of a random employee)

Change of business premises address

If business premises are changed with the change of business address, only changed information should be reported to FURS without closing the business premises and opening the new one. The following needs to be done:

- In Your company -> Addresses-> change Street/City, ZIP code, Province.

- Contact support to execute data forwarding to FURS. Indicating which address has been changed is mandatory.

Instructions for MetaKocka support:

- sendFursBusinessPremise call should be used. In businessUnitMark, FURS designation of business premises should be entered. After a successful call, in FURS requests. After a successful call, check whether the request together with an appropriate answer has been genuinely sent in FURS requests.

- FURS elaboration is in FD74490 request

To successfully configure Fiscal cash registers, the following is needed:

- certificate, which can be obtained on the eDavki portal

- cadastre data of business unit(s), from which the issuing of invoices will take place

- personal tax numbers of all users which will issue the cash invoices

Configuration steps (Settings/Your company)

- certificate, which can be obtained on the eDavki portal

- cadastre data of business unit(s), from which the issuing of invoices will take place

- personal tax numbers of all users which will issue the cash invoices

Configuration steps (Settings/Your company)

1.) Search for the “Fiscal registers” option and turn it on (the picture below).

Save settings and the program will execute logging out and re-logging.

Certificate transfer - A button for uploading the certificate will be displayed - click on it

Select/install a certificate that was received from the eDavki portal, for signature and data sending to FURS (http://www.datoteke.fu.gov.si/eDavki/PrevzemNamenskegaDigitalnegaPotrdila.pdf). For the successful transfer of the certificate, use the same password in the dialogue that you entered when downloading it from FURS.

In case of issuing invoices with different means of payment (i.e. deferred payments on the bank account), selectively sending invoices or selectively refrain from sending them to FURS can be activated for Wholesales.

FURS data - In the bottom part of the form (Settings/Your company) additional tab ''FURS data'' is displayed

Enter the following in the tab:

- designation of business premises as previously specified in the internal act. Should be no longer than 3 characters.

- cadastre data for each company's branch, from which invoices are issued (the picture above).

In case of facing issues when acquiring cadastre data, the following link might be helpful:

http://prostor3.gov.si/javni-arhiv/javniVpogled.jsp?rand=0.6326335820321506

3.1 Address

In the Address tab, enter the city in which the bussiness unit is located

Data entering - Users issuing the invoices

- Each user that will be issuing invoices must have a respective name, surname, and personal tax number denoted (the picture below)

- User needs to have a business unit assigned, from which he/she will be issuing invoices

- Also set up the following: business unit warehouse, cash register, retail customer, price list - authorities

Additional options

When a certificate is successfully configured, an additional option - Optional sending to FURS on wholesale'', will be displayed, mainly intended for issuing the invoices for Wholesale (if cash invoices are not issued in domestic/foreign sales, jump to point 4.) and invoices will not be sent to FURS after their printing (since the payment is received on the bank account) - if such a type of payment is supported, tick the ''Enable'' field.

Then, at the top of the invoice, select numeration that is not intended for fiscal verification or numeration that is intended for fiscal numeration, as shown in the picture below. Once the numeration is selected, it cannot be modified anymore.

If the wrong numeration is selected and the invoice is already saved, the invoice needs to be canceled and reissued

-Options for activating other functions are also available:

1. Also for wholesale - if you selling in Retail and you want to tax-verify invoices in wholesale as well (especially online stores must select this option), tick the box next to it.

2. Invoice duplicate book - if using an invoice duplicate book, you may transfer those invoices to MetaKocka.

On the retail invoice, there is an ''Invoice duplicate book'' field, tick the box next to it to enter data from invoice the duplicate book.

3. Automatic invoices and credit notes tax-verification - that way, invoices, and credit notes will be verified in the evening hours if they have not been already verified from your side (invoices are tax-verified when printed)

Invoices numeration

If you want to change the prefix, that can be done for each business unit.

Settings/ Numbering/:

Upon saving, you can start issuing invoices. Invoices are verified at FURS once they are printed for the very first time.

User for automatic issuing of invoices

If invoices are not created by users (i.e. automatic creation via API calls), it is not appropriate, to list a person as the invoice issuer if he/she has not participated in such a procedure. Suggested is the creation of a special user, to whom the Business unit and Tax number have to be assigned either way so that invoices can be tax-verified. Select the company's headquarters as the business unit address, while for the tax number, it is mandatory to use the company's tax number without the country code (do not enter the tax number of a random employee)

Change of business premises address

If business premises are changed with the change of business address, only changed information should be reported to FURS without closing the business premises and opening the new one. The following needs to be done:

- In Your company -> Addresses-> change Street/City, ZIP code, Province.

- Contact support to execute data forwarding to FURS. Indicating which address has been changed is mandatory.

Instructions for MetaKocka support:

- sendFursBusinessPremise call should be used. In businessUnitMark, FURS designation of business premises should be entered. After a successful call, in FURS requests. After a successful call, check whether the request together with an appropriate answer has been genuinely sent in FURS requests.

- FURS elaboration is in FD74490 request